Seattle Home for Sale

Most of the best Seattle homes are selling the first few days they come on the market, oftentimes with multiple offers.

National portals can take over a week to upload new home listings to their websites, and even longer to remove sold listings. BrennerHill updates their website several time an hour with new listings. Our home buyers see the newest listings first, and they have a better chance at finding the right home before it's sold.

Seattle homes for sale HERE.

If you would like to work with brokers who put you first and are able to show you homes they day they come to market, give us a call, text or email today and don't lose out on another home!

Give us a call, text or email today!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

If You Were Selling Today, Would You Have the Home That Buyers Want?

by Dona DeZube

Knowing what appeals to today’s homebuyers, and considering those trends when you remodel, can pay off years from now when you sell your home.

Two new surveys about what homebuyers want have me feeling pretty smug about my own home choices. Maybe you’ll feel the same.

Privacy from neighbors remains at the top of the most-wanted list (important to 86% of buyers), according to the NATIONAL ASSOCIATION OF REALTORS’® “2013 Community Preference Survey.” Privacy is no doubt the best feature of my mid-century ranch home, since I can only see one neighbor’s house and it’s a couple hundred feet down my driveway.

It may not be practical to move your neighbors farther away (although I’m sure many people wish they had that superpower), but you can increase your home’s privacy (and therefore its resale value) by planting a living privacy screen of trees and shrubs or by physically screening off your patio.

1. More and more generations are living together. Another NAR survey, the “2013 Profile of Home Buyers and Sellers,” found 14% of buyers purchased a home suited to a multigenerational household due to children over the age of 18 moving back into the house, cost savings, and the health and caretaking of aging parents.

I did that back when my parents were still alive, and it worked out great for everyone. I didn’t have time to let my infant daughter nap on my shoulder all afternoon, but my mom did. She couldn’t drive to church meetings at night, but I could take her. And neither of us liked cleaning the gutters, but my husband didn’t mind that chore.

Even if you’d rather live in a cardboard box than with your mother, you might want to consider the multigenerational living trend when you’re remodeling. For instance, opting for a full bath when finishing the basement could offer more convenience for you now and boost your home’s resale value by making it more appealing to a multigenerational family.

2. On average, homeowners live in their home for nine years. That’s up from six years in 2007. Since you’ll be in your home for a long time, it makes sense to remodel to suit your taste but also with long-lasting marketability in mind. After all, you don’t want to have to redo stuff. For instance, you can go for trend-defying kitchen features, like white overtones and Shaker-style cabinets, which work with a variety of styles.

I feel compelled to caution against going so far out of the norm for your neighborhood that it’ll turn off potential buyers even nine years from now. (It never hurts to get your REALTOR®’s opinion on your remodeling plans.)

3. Homebuyers love energy efficiency. Heating and cooling costs were “somewhat” or “very important” to a whopping 85% of buyers. If your home could use an energy-efficiency upgrade, go with projects that have a solid return on investment, like sealing your air leaks and adding attic insulation. You’ll save money on your utility bills now and when you’re ready to sell, your home will appeal to buyers looking for efficiency.

By the way, to take back your energy bills, you need to do at least four things. One to two fixes won’t cut it, thanks to rising energy costs.

About two-thirds of survey respondents also thought energy-efficient appliances and energy-efficient lighting were important. Tuck away your manuals and energy-efficiency information when you buy new appliances and lighting. When you’re ready to sell (in nine years) you can pull those out and display them where buyers will see them.

If you have questions about preparing your home for sale, give us a call, text or email. We would love to answer your real estate related questions!

?-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

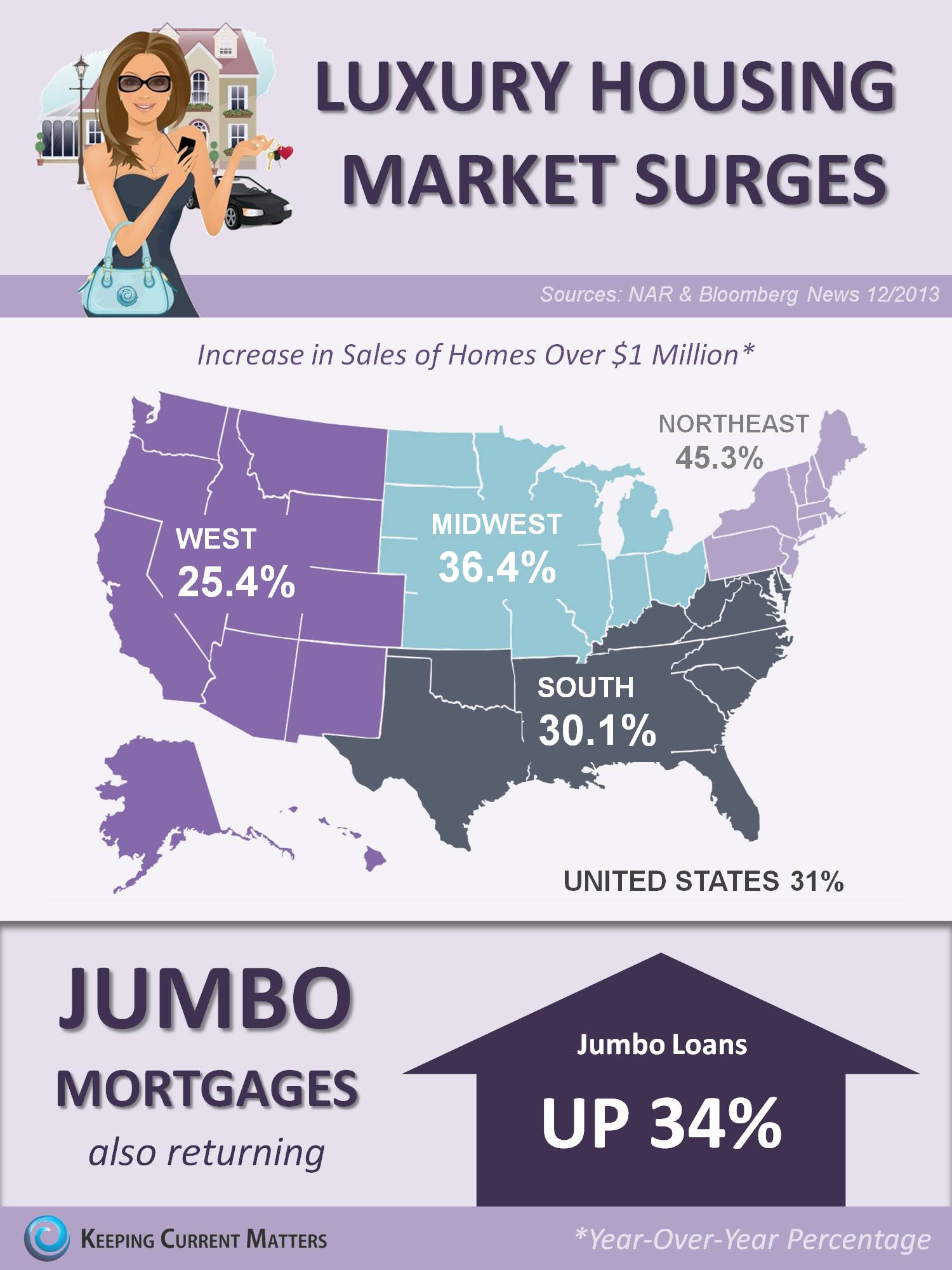

Luxury Housing Market Surges

If you are considering a luxury home purchase, give us a call, we would love to help you find the perfect new home! For great rates and excellent service, give one of our preferred lenders a call, see their contact information below.

If you are considering a luxury home purchase, give us a call, we would love to help you find the perfect new home! For great rates and excellent service, give one of our preferred lenders a call, see their contact information below.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Just Listed! Seattle Home for Sale

OPEN TODAY 1PM-4PM

4130 Cascadia Ave S

Seattle WA 98118

Stunning territorial views, gleaming hardwood floors and tastefully updated kitchen highlight this lovely Seattle home. Immersed in warm natural light, this home boasts a seamless floor plan that features spacious living room with fireplace, kitchen with eating nook, expansive family room and abundant storage space. Enjoy entertaining and playtime in the large and level fenced back yard. Conveniently located near shopping, schools and light rail, this home, with a Walk Score of 84, has it all!

Online at ExclusivelySeattle.com

Stop by today between 1PM and 4PM to see this wonderful Seattle home.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Make the Most of Your Home Inspection

by

by

A home inspection is a crucial element of any home purchase. Most buyers make their purchase offer contingent on the results of a home inspection so they can decide not to buy if the inspection reveals significant structural problems. In a market with heavy competition for homes, buyers sometimes waive the home-inspection contingency to make their offer more appealing to the sellers. Even in those circumstances, it’s advisable to schedule an “information-only” inspection so you know what you’re buying.

Your home inspection can cost between $300 and $500, depending on where you live and the size of the property you’re having inspected. It’s worth spending a few hundred dollars to learn about the potential pitfalls of your future home.

What to expect from your home inspector

Your Realtor can recommend a home inspector, but you may also want to get recommendations from your lender and an attorney. Check out each home inspector’s credentials and reputation online and ask how many inspections each has completed. Most home inspectors will provide a written report after the inspection, but you should ask to see a sample report and how long it will take until you receive your report before choosing your inspector.

Prep for your inspection

You should always attend the inspection since this is your opportunity to learn about how to take care of your home.

Before your inspection look over the interior and exterior of the property for potential problems and areas you would like the inspector to review carefully, such as dark spots in the basement or underneath the bathroom sinks that could be water damage. Depending on the rules in your area, the seller may be required to disclose known defects in the home. Ask the seller’s agent, your buyer’s agent, and even the neighbors if they know about any issues with that house or others in the community — such as basements that flood.

Prepare a list of questions for the inspector and bring a notebook or tablet so you can take notes.

What to do during your inspection

While your inspector is looking for major issues such as a foundation problem, a leaky roof or mold, you should also use the hours of your inspection to learn how to take care of the home and its systems. Find out where the water shut-off valve is and ask for advice on how to maintain the property. Most home inspectors can tell you the life expectancy of your appliances so you can avoid being surprised when it’s time to replace the water heater. A good inspector will also point out small repairs you should make after you move into the property.

If the inspector finds a major problem with the home you intend to buy, you’ll need to consult with your Realtor and review your contract to decide how to handle the problem. Depending on what the inspection reveals, you may want to pull out of the deal or request that the sellers address the issue. You, the sellers and your agents can negotiate whether you want the sellers to fix a problem, give you a credit at settlement, or cash to make the repairs after you move in.

A good home inspection should do more than look for flaws, it should prepare you for homeownership.

If you have any questions about home inspections, give us a call, text or email. We are happy to answer your real estate related questions!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Seattle Home for Sale

OPEN SUNDAY 1PM-4PM

4130 Cascadia Ave S

Seattle WA 98118

Stunning territorial views, gleaming hardwood floors and tastefully updated kitchen highlight this lovely Seattle home. Immersed in warm natural light, this home boasts a seamless floor plan that features spacious living room with fireplace, kitchen with eating nook, expansive family room and abundant storage space. Enjoy entertaining and playtime in the large and level fenced back yard. Conveniently located near shopping, schools and light rail, this home, with a Walk Score of 84, has it all!

Online at ExclusivelySeattle.com

Stop by Sunday, December 22, between 1PM and 4PM to see this wonderful Seattle home.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

20 Weekend Projects Under $20

These 20 improvements may not cost a lot, but they'll make a big difference in how your home functions. Complete one or more of these projects this weekend.

These 20 improvements may not cost a lot, but they'll make a big difference in how your home functions. Complete one or more of these projects this weekend.

1. Replace a Window Treatment

Has the window shade above your kitchen sink been marred by repeated exposure to splashes and cooking liquids? Replace a stained window covering with an inexpensive fabric treatment and see your kitchen in a whole new light.

Read on HERE.

If you are considering home improvements to sell your home, give us a call, text or email. Let us show you what improvements will provide you the best return on your investment!

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Seattle City Council Approves New North Precinct Police Station

Seattle City Council Approves Acquisition of Property for a New North Preceinct Police Station

On Dec. 16, 2013, the City Council approved the legislation authorizing the acquisition of three parcels – located at the southeast corner of Aurora Avenue North and North 130th Street – for a new North Precinct Police Station. The City of Seattle intends to acquire ownership of this property using its power of eminent domain (condemnation) for public use. Such an action keeps the project on track and is favorable to the property sellers as well because it allows them additional time to reinvest the money they receive from the sale before capital gains taxes are due.

Links to news and updates can be found on this page on the project website: http://www.seattle.gov/new-

This is great news for our clients who live in North Seattle neighborhoods.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Why Today’s Homebuyer Needs a Real Estate Agent More Than Ever

Last summer I got an email from a local real estate attorney who wanted to buy a house. He’d just gotten engaged and wanted to save some money by representing himself.

This attorney wanted to do all the work an agent would do to find and buy his first home, and get paid a commission for his work. I explained to him that the commission is payable to the listing agent who agrees to pay a portion of it to the Realtor representing a buyer.

Usually, if there’s no buyer’s agent, the seller’s agent gets the entire commission. Some agents will accept a reduced commission for representing both parties. The seller saves some money that way. Sometimes the savings get passed along to the buyer.

I get several emails each year from homebuyers, usually first-timers, who want to know how they can get a real estate license so they can save money on the purchase of a home. They find me through my blog, and apparently decide that I am too scary to work with, but not so scary that they can’t ask me a question or two.

I always let them know that they do not need a license to buy a home, and that they do not need a real estate agent. After I explain to them how to get a license — and that they have to work through a broker, who generally gets a percentage of each commission — they start to let go of their dream of being paid to find their own home.

The buyers who want to do this are usually planning on buying a home that costs $300,000 or more — higher than average for a first-time homebuyer in this market — and planning on saving at least $9,000 by doing the work themselves.

– See more at: http://www.inman.com/2013/12/12/why-todays-homebuyer-needs-a-real-estate-agent-more-than-ever/#!

Last summer I got an email from a local real estate attorney who wanted to buy a house. He’d just gotten engaged and wanted to save some money by representing himself.

This attorney wanted to do all the work an agent would do to find and buy his first home, and get paid a commission for his work. I explained to him that the commission is payable to the listing agent who agrees to pay a portion of it to the Realtor representing a buyer.

Usually, if there’s no buyer’s agent, the seller’s agent gets the entire commission. Some agents will accept a reduced commission for representing both parties. The seller saves some money that way. Sometimes the savings get passed along to the buyer.

I get several emails each year from homebuyers, usually first-timers, who want to know how they can get a real estate license so they can save money on the purchase of a home. They find me through my blog, and apparently decide that I am too scary to work with, but not so scary that they can’t ask me a question or two.

I always let them know that they do not need a license to buy a home, and that they do not need a real estate agent. After I explain to them how to get a license — and that they have to work through a broker, who generally gets a percentage of each commission — they start to let go of their dream of being paid to find their own home.

The buyers who want to do this are usually planning on buying a home that costs $300,000 or more — higher than average for a first-time homebuyer in this market — and planning on saving at least $9,000 by doing the work themselves.

– See more at: http://www.inman.com/2013/12/12/why-todays-homebuyer-needs-a-real-estate-agent-more-than-ever/#!

by Theresa Boardman

by Theresa Boardman

Last summer I got an email from a local real estate attorney who wanted to buy a house. He’d just gotten engaged and wanted to save some money by representing himself.

This attorney wanted to do all the work an agent would do to find and buy his first home, and get paid a commission for his work. I explained to him that the commission is payable to the listing agent who agrees to pay a portion of it to the Realtor representing a buyer.

Usually, if there’s no buyer’s agent, the seller’s agent gets the entire commission. Some agents will accept a reduced commission for representing both parties. The seller saves some money that way. Sometimes the savings get passed along to the buyer.

I get several emails each year from homebuyers, usually first-timers, who want to know how they can get a real estate license so they can save money on the purchase of a home. They find me through my blog, and apparently decide that I am too scary to work with, but not so scary that they can’t ask me a question or two.

I always let them know that they do not need a license to buy a home, and that they do not need a real estate agent. After I explain to them how to get a license — and that they have to work through a broker, who generally gets a percentage of each commission — they start to let go of their dream of being paid to find their own home.

The buyers who want to do this are usually planning on buying a home that costs $300,000 or more — higher than average for a first-time homebuyer in this market — and planning on saving at least $9,000 by doing the work themselves.

I decided that helping the attorney would be an excellent learning experience for me. So I agreed to help him buy a house without a real estate agent if he would share his experiences with me so that I could learn how to better help my buyers and sellers

He started his search for a home the next weekend. I advised him on how to ask for a price reduction, or have the seller pay closing costs, equal to roughly what the listing broker was expecting to pay out to a cooperating broker bringing a buyer to a sale.

I told him not to use the contracts that lawyers use, but to use the contracts that real estate agents use. I advised him to write the price reduction into the contract, and explained to him that agents do not have to cut their commissions.

If I were representing a seller who got such an offer from an unrepresented buyer, I told him, I would certainly consider cutting my commission — and I suspect I would get a little pressure from my sellers to do so.

The following Monday, he emailed the wording of the first offer he planned to submit.

I made several suggestions on how to make the offer better and more competitive, so that he would have a chance in a multiple-offer situation. We shortened the inspection period and removed some additional contingencies he had put into the offer that were unnecessary.

He wrote offers on five houses where he was competing in multiple-offer situations. None was accepted. Most buyers would have given up even if they had been working with an agent. But this guy was on a mission.

There were no other offers on the home he finally bought. He spent many, many hours looking at houses, doing research and juggling appointments with listing agents.

When he was done, he told me that if he did not love real estate and have a passion for it, he never would have had the patience or taken the time to work without an agent. He could have made more money than he saved, he said, if all the hours he’d spent searching for and negotiating a home purchase had instead been spent working his job as a lawyer, generating billable hours for clients.

One of the biggest challenges he had was scheduling appointments to see the houses, and seeing the home before someone made an offer. He found some of the real estate agents to be helpful. Others clearly did not know what they were doing, and that made it harder for him to buy the house.

The house he ended up with was overpriced and, as a result, did not get any other offers. He was able to buy the house for slightly less than market value.

When I complimented him on his negotiating skills, he told me why the seller accepted his offer. It came down to the buyer being in the right place at the right time. But he also did his homework, and knew the approximate value of the house.

He saw that it was overpriced, and was not afraid to make an offer that was significantly less than asking. It is often very difficult to convince buyers to make a fair offer that is significantly below the asking price.

This lawyer got no advice from me on how much to offer, which houses to make offers on, or which ones to look at. But I did tell him which websites have the most accurate information, and the greatest number of homes that are really for sale.

I gave him a little guidance on strategy, business practices and how to use Minnesota real estate contracts. He tended to write offers without considering the seller at all. I encouraged him to get as much help from his lender as he could.

I think it was easier for buyers to represent themselves when it was a buyer’s market. Multiple-offer situations are very common today, and he lost every time he competed in such a situation. Today’s buyer often has to compete with experienced agents, and may be at a disadvantage.

Just this week I got an email from a buyer who wants to save money by working alone instead of with a real estate agent. He started this endeavor by asking me, a real estate agent, questions. So I know we still have some credibility.

First-time buyers, in particular, seem to feel as though we get paid way more than we should, and some are not so sure we are worth it. I advised him that if he does not want to work with agents he should also consider approaching homeowners who are not working with agents.

Earlier this week I went to a closing for a buyer who had purchased his ninth home and would not even consider doing it without an agent.

He asked for my advice every step of the way, and made it clear upfront that he was looking for an agent who has more experience than he does.

That is what my clients are paying for. And that’s all the attorney who wanted to do the agent’s work himself needed from me, too.

Teresa Boardman is a broker in St. Paul, Minn., and founder of the St. Paul Real Estate blog.

If you are looking for experienced real estate brokers in the Seattle and Greater Puget Sound area, give us a call, we would love to guide you through your home purchase.

-Steve and Sandra

Steve Hill and Sandra Brenner

Windermere Real Estate/FN

Seattle-Northwest

122502 Greenwood Ave N

Seattle WA 98133

call/text: 206-769-9577

email: stevehill@windermere.com

Check out these useful Home Search Apps:

Windermere for iPad

Windermere for Android

Check out these useful links:

BrennerHill.com

Best In Client Satisfaction

Seattle Real Estate Statistics

Windermere Housing Trends Newsletter

Our Preferred Lenders

George Runnels

Washington First Mortgage

WaFirstMortgage.com

call/text: 206-604-4545

Jackie Murphy

Cobalt Mortgage

CobaltMortgage.com

call/text: 425-260-6834

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership –

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. This year he released a new paper on homeownership –