Every December, Trulia’s Chief Economist Jed Kolko takes a look at the data and picks the top markets to watch in the new year. The list is always an attention-grabber and full of insights that agents can learn from to build a targeted, booming business, and this year is no exception. Check out our top markets to watch—and take a look at what makes each one so special!

Before we dive in, let’s get a little technical with how Trulia’s team selected these markets. For the past few years, the so-called “rebound effect” has driven real estate market trends. But that effect is beginning to fade. So what replaces the rebound effect in the next stage of the housing recovery? Well, the real estate market then increasingly depends on fundamentals such as job growth, rising incomes, and more household formation.

Because of this, our 10 markets to watch have strong fundamentals for housing activity. These include solid job growth, which fuels housing demand, and a low vacancy rate, which spurs construction. We gave a few extra points to markets with a higher share of millennials. These young adults are getting back to work and that will drive household formation and rental demand. We didn’t include markets where prices looked at least 5% overvalued in our latest Bubble Watch report.

Alright! Let’s take a look at the cities who made the list:

1. Boston, MA

This smarty-pants city has the greatest minds at its disposal, with more than 100 colleges and universities in the greater metro area. But that doesn’t necessarily make Beantown solely a party haven for coeds. Eventually those students grow into working professional 20-somethings looking to make a life for themselves. The Boston Globe reported last year that more than one-third of the city’s residents are between ages 20 and 34. Coincidentally, the latest Buyer and Seller Survey from the National Association of Realtors notes that 56 percent of first time home buyers are between the ages of 25 and 34.

2. Dallas, TX

You know the saying: Everything’s bigger in Texas. Well, Dallas just keeps getting bigger. The Dallas Morning News reported that the oil-rich city saw a 3.4 percent increase in jobs since last year in the manufacturing, retail, and energy industries. In the past 10 years, Dallas-Fort Worth has grown to become the fourth largest metropolitan area in the country, right behind the big three: New York, Los Angeles, and Chicago.

3. Fresno, CA

Sure, the California coast is beautiful, but a chunk of its population is moving to the more affordable inland parts of the state, like Fresno. The Fresno Bee says that Fresno’s population climbed nearly 15.7 percent for that very reason. The largest employers in the San Joaquin Valley city include medical centers, casinos, and, in the rural outskirts, agriculture.

4. Middlesex County, MA

Not familiar with Middlesex County? Don’t worry, you know exactly where it is — it’s a good chunk of land northwest of Boston that encompasses MIT and Harvard (which are technically in the city of Cambridge), Brandeis (in Waltham), and Tufts (in Medford). Much like Boston, this very educated county is one of the largest in New England and has been seeing steady growth.

5. Nashville, TN

You don’t have to be a country music fan to love what locals call Music City (but it might not hurt). It’s not only musicians who populate the city, which is also home to prestigious Vanderbilt University and the Scripps Networks company. The Tennessean reported that Nashville ranked seventh in growth among young professionals with college degrees, and the city has seen a 48 percent population hike in the past 12 years.

6. New York, NY-NJ

What more to say about New York City that hasn’t already been said in song, books, or in photographs? The Big Apple is a crowded city in demand and there never seems to be enough housing to go around — whether you’re renting or buying. Tough housing competition comes from foreign investors who want to put their money in the city, as well as New Yorkers looking to move, and, of course, out-of-staters looking to transplant.

7. Raleigh, NC

Once filled with tobacco fields, Raleigh has become a major metropolitan city with rapid growth since the 1990s. The capital city has also bounced back from the Great Recession — and then some — with a whopping recovery rate of 214 percent, with the main growth coming from jobs in tech, research, health, and education, according to the Charlotte Business Journal.

8. Salt Lake City, UT

Utah has become a hub for computer programmers, because tech companies like Adobe, Microsoft, Oracle, Xerox, and more have opened up offices in or around Salt Lake City, which has led to job growth.

In the past 24 months, the city has seen home values increase, but it’s mostly because it’s a good time to get a mortgage and buy in Salt Lake City.

9. San Diego, CA

This is a market on the rise. Downtown San Diego is getting better and better every year and has new condos under construction for folks who want to live right by the action of the trendy Gaslamp Quarter. When it comes to houses, San Diego is ranked the second most expensive city to buy one in.

10. Seattle, WA

Companies like Starbucks, Microsoft, Amazon, and UPS have provided steady job growth for the area, but, hey, Seattlites know how to rock, too — as the home of grunge, which is still popular in the music scene there.

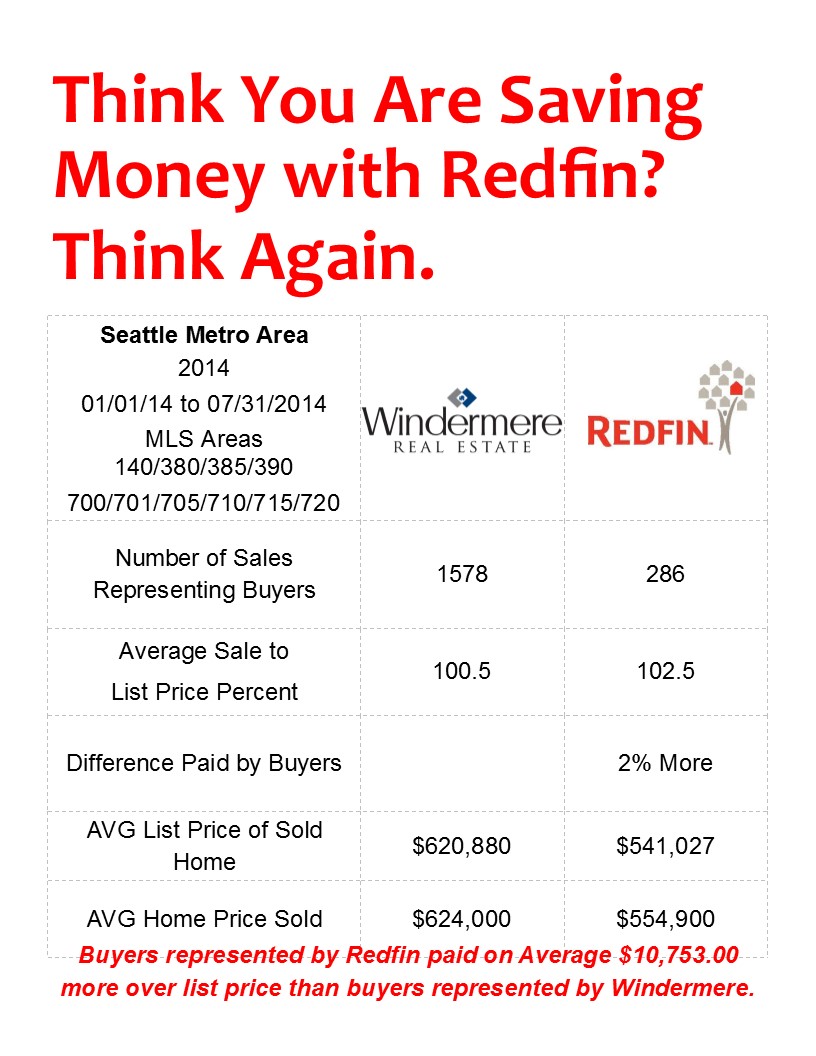

If you are curious about hyper local Seattle market, give us a call, text or email. We love talking about Seattle area real estate!

If you are curious about hyper local Seattle market, give us a call, text or email. We love talking about Seattle area real estate!

-Steve and Sandra

Steve Hill and Sandra Brenner

SEATTLE-NORTHWEST

Windermere Real Estate

206-769-9577

stevehill@windermere.com

BrennerHill.com

SeattleFreeHomeInfo.com

Your Instant Home Value

BrennerHillReviews.com

Heading into 2015 many people have their sights set on buying a home. The personal reasons differ for each buyer, with many basic similarities. Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top 5 financial benefits of homeownership his paper – The Dream Lives On: the Future of Homeownership in America. Here are the five reasons, each followed by an excerpt from the study:

Heading into 2015 many people have their sights set on buying a home. The personal reasons differ for each buyer, with many basic similarities. Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top 5 financial benefits of homeownership his paper – The Dream Lives On: the Future of Homeownership in America. Here are the five reasons, each followed by an excerpt from the study: We realize that homeownership makes sense for many Americans for an assortment of social and family reasons. It also makes sense financially. When you are ready to make the smart move into homeownership, give us a call, text or email and put our experience and negotiation skills to work for you!

We realize that homeownership makes sense for many Americans for an assortment of social and family reasons. It also makes sense financially. When you are ready to make the smart move into homeownership, give us a call, text or email and put our experience and negotiation skills to work for you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

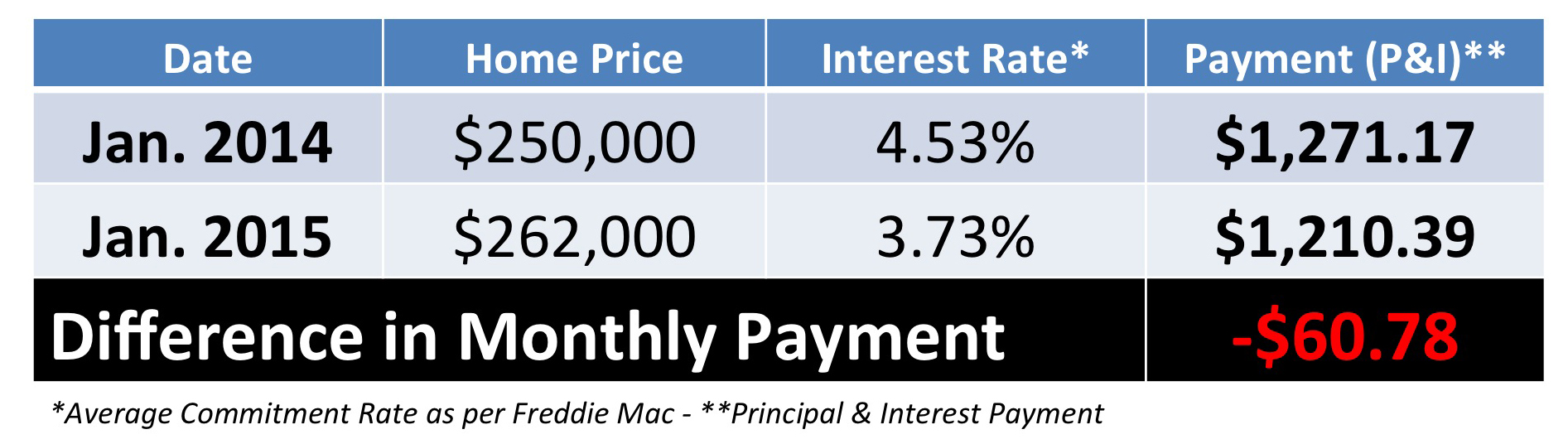

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. In most areas, prices are still below those of a few years ago. Also, interest rates are still near 4%. However, sellers should realize that waiting to make the move while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can buy will decrease. Here is a chart detailing this point:

Now that the housing market has stabilized, more and more homeowners are considering moving up to the home they have always dreamed of. In most areas, prices are still below those of a few years ago. Also, interest rates are still near 4%. However, sellers should realize that waiting to make the move while mortgage rates are increasing probably doesn’t make sense. As rates increase, the price of the house you can buy will decrease. Here is a chart detailing this point:

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are three questions you should ask before purchasing in today’s market:

If you are thinking about purchasing a home right now, you are surely getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in real estate. Let’s look at whether or not now is actually a good time for you to buy a home. There are three questions you should ask before purchasing in today’s market: There are many people out there who debated purchasing a home over the course of the last year, but ultimately did not. Whatever their reasons were for delaying, let’s look at whether the decision to wait to buy made sense.

There are many people out there who debated purchasing a home over the course of the last year, but ultimately did not. Whatever their reasons were for delaying, let’s look at whether the decision to wait to buy made sense. Many may say, “See waiting a year made total sense, I’m saving $60 a month.” And they’d be right, over the course of the year they saved $729.36. But what they haven’t realized, is that as the price of the home they purchased went up by $12,000, even if they just put a down payment of 5%, they had to come up with an additional $600 at the start of the process. So really they’ve only saved $129.36 in a year. Is a savings of $11 a month really worth holding off on pursuing a home to call your own after you weigh all the benefits that come along with that?

Many may say, “See waiting a year made total sense, I’m saving $60 a month.” And they’d be right, over the course of the year they saved $729.36. But what they haven’t realized, is that as the price of the home they purchased went up by $12,000, even if they just put a down payment of 5%, they had to come up with an additional $600 at the start of the process. So really they’ve only saved $129.36 in a year. Is a savings of $11 a month really worth holding off on pursuing a home to call your own after you weigh all the benefits that come along with that? According to Freddie Mac’s latest

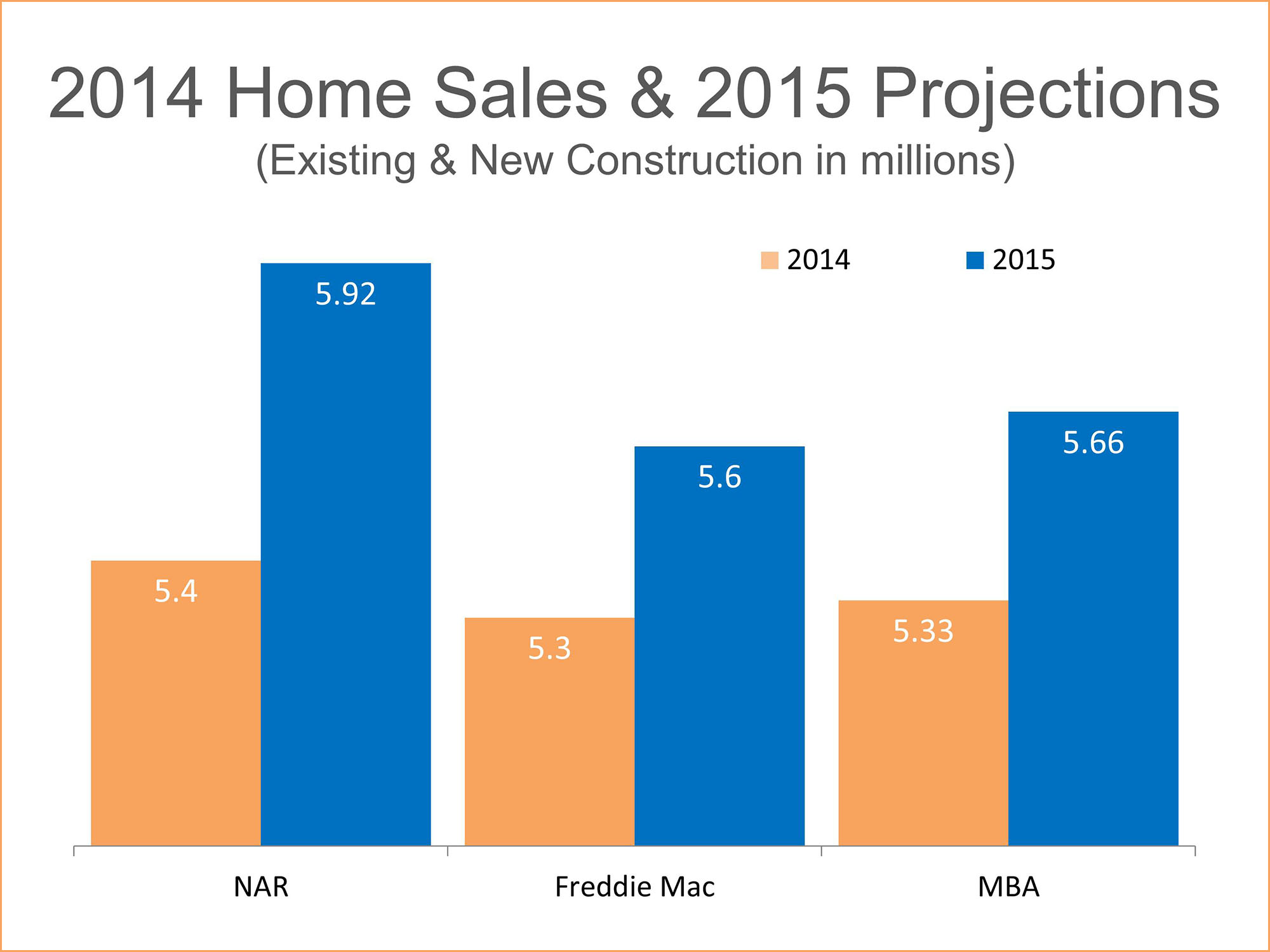

According to Freddie Mac’s latest  It seems that an improving economy and jobs market will mean a very healthy housing market.

It seems that an improving economy and jobs market will mean a very healthy housing market. -Steve and Sandra

-Steve and Sandra