Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership – The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year he released a paper on homeownership – The Dream Lives On: the Future of Homeownership in America. In his paper, Belsky reveals five financial reasons people should consider buying a home.

Here are the five reasons, each followed by an excerpt from the study:

1.) Housing is typically the one leveraged investment available.

“Few households are interested in borrowing money to buy stocks and bonds and few lenders are willing to lend them the money. As a result, homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

2.) You're paying for housing whether you own or rent.

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.”

3.) Owning is usually a form of “forced savings”.

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

4.) There are substantial tax benefits to owning.

“Homeowners are able to deduct mortgage interest and property taxes from income…On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

5.) Owning is a hedge against inflation.

“Housing costs and rents have tended over most time periods to go up at or higher than the rate of inflation, making owning an attractive proposition.”

Bottom Line

We realize that homeownership makes sense for many Americans for many social and family reasons. It also makes sense financially.

Give us a call text or email. Let's get together and discuss how we can assist you in finding your perfect Seattle area home!

-Steve and Sandra

-Steve and Sandra

Steve Hill and Sandra Brenner

SEATTLE-NORTHWEST

Windermere Real Estate

t's a spring fling all year ‘round! Lush territorial views greet you from nearly every room. This home sits high above the street and enjoys privacy and an abundance of natural light throughout the day. The main level features formal living spaces with fireplace and dining room with French doors to the sunny entertainment sized patio. Informal family room off of the kitchen provides a natural gathering spot. Master suite with bath and fireplace will be a welcome retreat at the end of the day.

For a private showing of this or any Seattle area home, give us a call, text or email. We are ready to get to work for you!

For a private showing of this or any Seattle area home, give us a call, text or email. We are ready to get to work for you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Recently, we have suggested that the Millennial generation’s struggles with student debt and the overarching concept of homeownership are not the reasons for so many first time buyers hesitating to move forward with the purchase of their first home. Now there is another firm suggesting the same. The asset management company, Nomura, came out with strong guidance to their investors. According to an article in Housing Wire last week:

Recently, we have suggested that the Millennial generation’s struggles with student debt and the overarching concept of homeownership are not the reasons for so many first time buyers hesitating to move forward with the purchase of their first home. Now there is another firm suggesting the same. The asset management company, Nomura, came out with strong guidance to their investors. According to an article in Housing Wire last week: We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest

We all realize that the best time to sell anything is when demand is high and the supply of that item is limited. The last two major reports issued by the National Association of Realtors (NAR) revealed information that suggests that now may be the best time to sell your house. Let’s look at the data covered by the latest

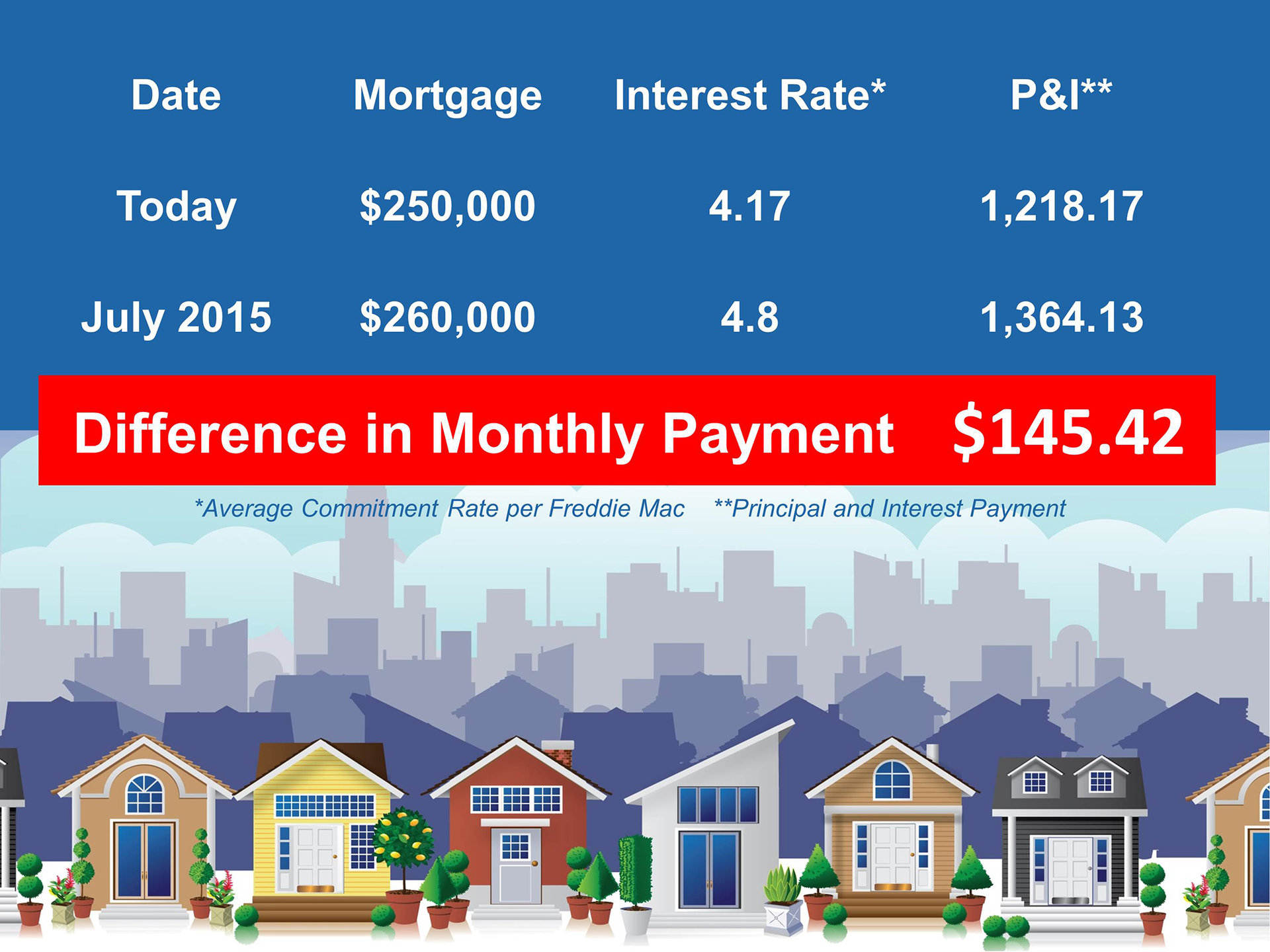

MORTGAGE INTEREST RATES

MORTGAGE INTEREST RATES

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also