by Tom Kelly, My Northwest

by Tom Kelly, My Northwest

Remember when the building inspector's report used to tell the buyer and seller the condition of the house and, if any major repairs or structural corrections were needed, the two parties would adjust the sales price?

Now more than ever, potential buyers are using minor flags in the inspector's report to withdraw or counter offers on houses. And, consumers also have come to expect more than a check of the basic health of the electrical and plumbing systems.

While some inspectors have attempted to become more thorough, they cannot see through walls nor be absolutely certain of the quality of all materials and craftsmanship. And to compound the problem, their reports now contain hold-harmless agreements and qualifying phrases (a result of lawsuits) that make some consumers wonder what service the $550 inspection fee is buying.

Courts and expectations have taken the basic structure from structural inspections. Look past the peeling paint and basic wear and tear, however, before demanding a price reduction.

The inspector's job is to highlight the negatives and some buyers aren't ready for all the negativity. What often happens is that a potential buyer suddenly faces a report that seems too picky and derogatory. That experience generates remorse and thoughts like, "Do we really want to move? The home we have isn't so bad after all."

For sellers, such reports can be infuriating report cards on conditions they inherited from the previous owner.

I don't blame the building engineers and inspectors for doing their job, which is to find structural flaws in a house. And I think inspections really protect both buyer and seller.

However, consumers need to know up front that inspectors do not tear open wallboard to probe interior spaces. Just because an item does not make the "laundry list" this does not mean it is satisfactory or in working order – especially if it can't be seen.

For example, a friend, who was presented with a qualified buyer and two backup offers, recently found herself in a typical situation. Her building inspection passed with no significant problems. The bank appraiser then arrived to ascertain the market value of the home and called for a pest inspection. The pest inspection discovered termites and dry rot that had existed for many years.

The woman was surprised to discover that those conditions were not covered in the building inspection. But inspectors do not always probe for pests, and they rarely perform environmental testing for materials such as asbestos, urea formaldehyde insulation and radon.

Many inspections do not include intercoms, appliances, smoke detectors, pools and pool equipment, hot tubs, saunas, elevators, dumbwaiters, heat pumps, furnace heat exchangers, electronic air cleaners, air conditioning systems, gas space heaters, gas fireplace accessories, solar systems, wall insulation, sewage disposal systems, water and "specialty items" like alarm systems.

Rarely is anything positive mentioned in an inspector's verbal or written report, even when thousands of dollars have been spent to correct or remodel a potentially disastrous situation.

For example, several years ago we purchased a large home. We hired one of the most popular and established home-inspection firms in the area. The inspector said some of the improvements made by the previous owner were not up to the quality of the original construction.

We spent six years and thousands of dollars correcting interior shortcomings. Among other things, we remodeled a second-floor bathroom that had a tub about to fall through the first-floor ceiling. We also completely remodeled the kitchen and replaced dangerous wiring.

When we sold the home, the report given to the new buyers – by the same inspector – stated "the room has been remodeled since my last inspection" and there was no mention of most of the other improvements.

Real-estate agents, lenders and escrow officers should remind consumers that the inspection report will be a negative laundry list of everything the inspector "sees." It is not necessarily a complete list because one inspector might not "find" the same things another one would.

Structural inspections are extremely valuable and I think all buyers should have one. They also provide the seller with protection from future claims, but they don't come laced with seashells and balloons.

Get ready for a poor report card and use it as a negotiating tool only if the problems are major league.

Get ready for a poor report card and use it as a negotiating tool only if the problems are major league.

Whether you are considering a home sale or purchase, let us guide you the process from search to inspection to close.

-Steve and Sandra

Steve Hill and Sandra Brenner

SEATTLE-NORTHWEST

Windermere Real Estate

206-769-9577

stevehill@windermere.com

BrennerHill.com

BrennerHillReviews.com

Your Instant Home Value

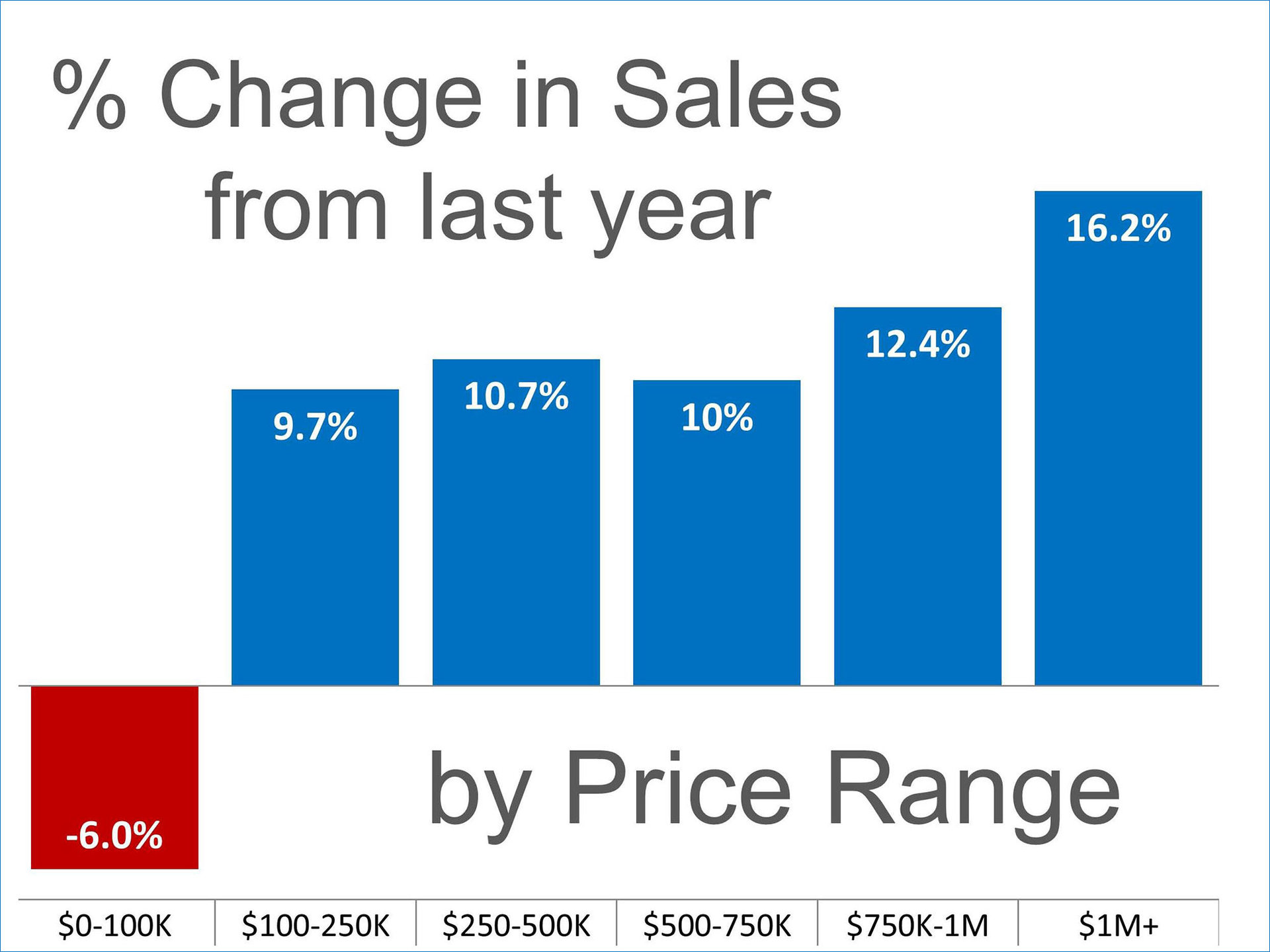

The National Association of Realtors’ most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-6%). Every other category showed a minimum increase of at least 9.7%.

The National Association of Realtors’ most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure. Only those homes priced under $100,000 showed a decline (-6%). Every other category showed a minimum increase of at least 9.7%.

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with us and see if it is priced appropriately to compete in today’s market.

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with us and see if it is priced appropriately to compete in today’s market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Every year the National Association of REALTORS releases their

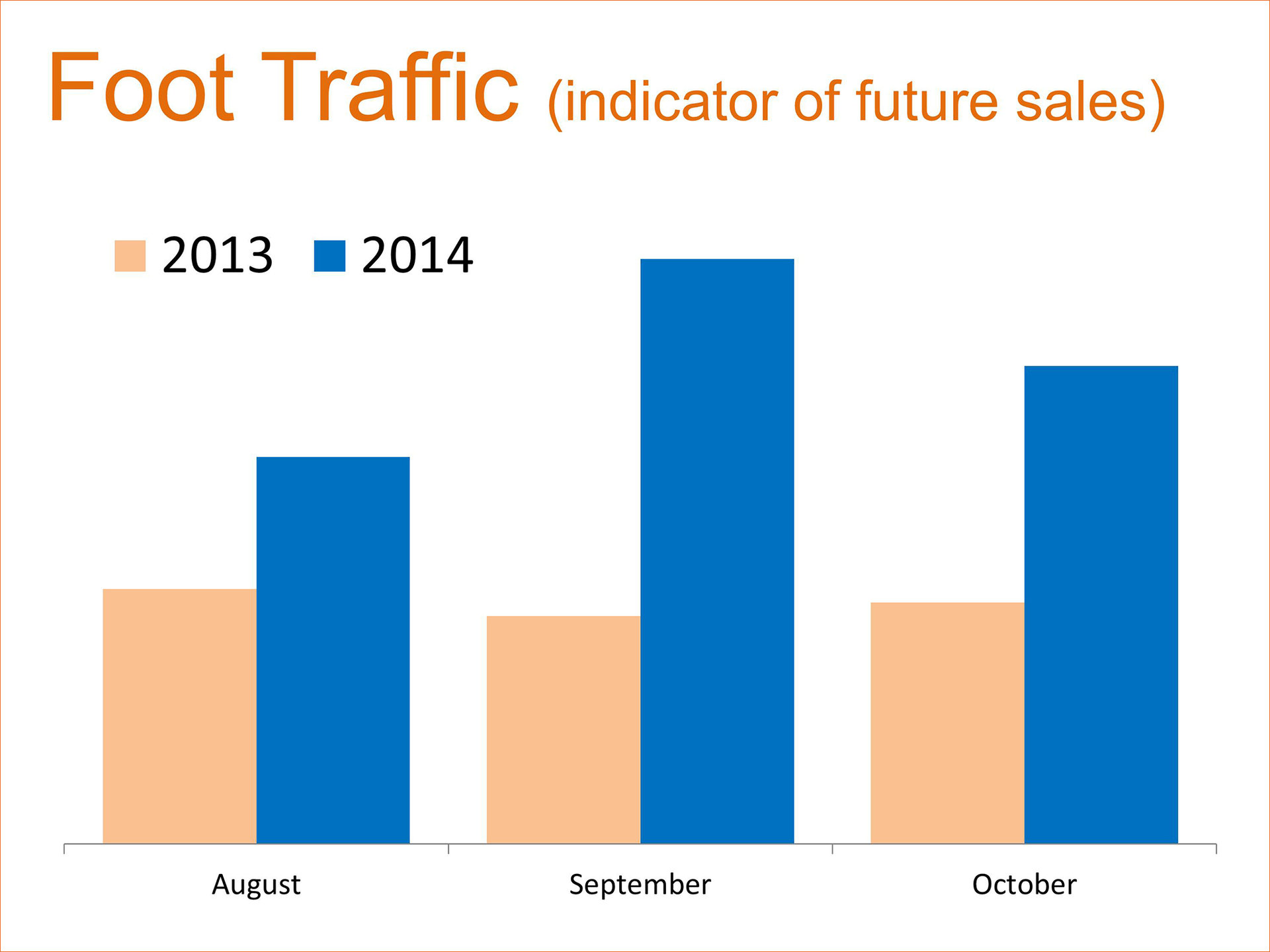

Every year the National Association of REALTORS releases their  Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months. The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the Fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart below).

Most homeowners believe that the winter is not a good time to sell. This belief is based on the fact that historically the number of buyers decreases in the winter and then increases dramatically during the spring buying market. Though this is still true, there is an interesting pattern developing over the last few months. The number of prospective purchasers actively looking at a home (foot traffic) has remained strong going into the Fall. As a matter of fact, the foot traffic far exceeds the numbers reported for the same months last year (see chart below).

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.  Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership –

Eric Belsky is Managing Director of the Joint Center of Housing Studies at Harvard University. He also currently serves on the editorial board of the Journal of Housing Research and Housing Policy Debate. Last year, he released a paper on homeownership –  After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a

After it was announced that Fannie Mae and Freddie Mac would again make available mortgage loans requiring as little as a