Many of our clients ask us where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject.

Many of our clients ask us where interest rates are headed over the next several months. While no one has a crystal ball, we did want to share what some experts are saying on the subject.

“For now, and likely through the summer, we may see data-driven bumps and dips in rates. Although we managed a slight dip presently, a bump is in order before long.”

“In the next few months, mortgage rates are likely to remain at their current, low level, but will not remain there for long. As the Federal Reserve is expected to ‘taper’ its purchases of long-term Treasuries and mortgage-backed securities, and as economic growth picks up, long-term yields will gradually rise. Fixed-rate mortgages are expected to be higher in six months, and may even approach 5 percent a year from now.”

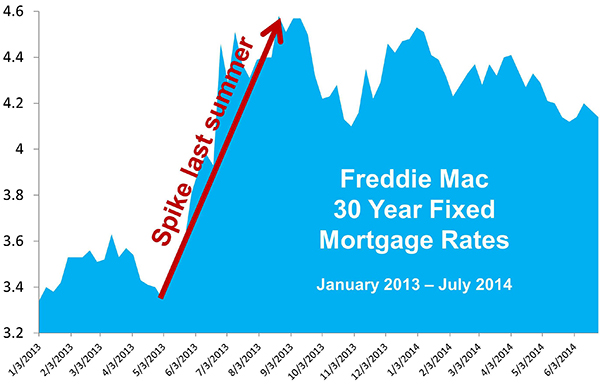

“Mortgage rates could move suddenly higher in anticipation of rate increases, much as they did last summer when refinance and transaction activity was high. Steady purchase transaction volume and lower refinance volume could mean that mortgages rates may adjust in a more gradual fashion. In either case, as the economy improves—and today’s data clearly suggests it is improving—the overall trend for mortgage rates is up, not down.”

Projects the 30 year fixed mortgage rate to be 4.3% by the end of the year.

Projects the 30 year fixed mortgage rate to be 4.7% by the end of the year.

If you have questions about current mortgage rates and need a great lender, give us a call, text or email. Let us put you in touch with people we like, know and trust.

If you have questions about current mortgage rates and need a great lender, give us a call, text or email. Let us put you in touch with people we like, know and trust.

-Steve and Sandra

Steve Hill and Sandra Brenner

SEATTLE-NORTHWEST

Windermere Real Estate

SEATTLE-NORTHWEST

Windermere Real Estate

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link